Private Universities Propose Radical Changes on Student Funding.

The government is facing increased financial strain in the higher education sector as private universities demand a long-overdue payment of Sh50 billion. The Kenya Association of Private Universities (Kapu) revealed that the debt has accumulated since 2016 when the government initiated a sponsorship programme for students placed in private institutions.

Although the programme was discontinued in 2023, a significant number of government-sponsored students are still enrolled in private universities. The declining government sponsorship over the years has placed a heavy financial burden on these institutions, severely affecting their operations.

Impact of Pending Bills on Private Universities

The demand for payment comes at a time when the government is already dealing with an Sh80 billion debt owed by public universities to various creditors and state agencies such as the Kenya Revenue Authority.

The vice chancellors of 34 private universities, who convened in Mombasa to address their financial concerns, urged the State to clear the accumulated debt to ease their financial strain and operational challenges. Kapu serves as the umbrella body representing private universities in Kenya.

During the meeting, Kapu Chairman Stephen Ngari stated that while they appreciate the partnership with the government in developing human capital, the State has failed to meet its financial commitments. He noted that the outstanding Sh50 billion covers unpaid disbursements for students, many of whom have already graduated.

The Catholic University of Eastern Africa (CUEA) Vice Chancellor echoed these concerns, emphasizing the urgency of settling the debt, which dates back to the 2015–2016 academic year. He pointed out that some continuing students have yet to receive their promised allocations, exacerbating the financial strain on institutions.

Radical Changes on Student Funding.

Private universities have submitted a proposal to the Ministry of Education advocating for significant reforms in higher education funding. If adopted, the proposal by the National Association of Private Universities in Kenya (Napuk) suggests a shift towards loan-based student financing, with scholarships reserved for priority programmes and grants significantly reduced.

The proposal, addressed to Education Cabinet Secretary Julius Ogamba and received at the Ministry on February 11, 2025, argues that the existing funding frameworks have been unsustainable and inequitable.

Napuk calls for a transition from what it describes as a “social-welfare orientation” to a model that emphasizes sustainability by offering recoverable loans. Scholarships would be allocated strictly based on performance and affordability within government-prioritized programmes.

Napuk outlines several measures to generate funding for higher education. These include the introduction of levies such as education bonds and the utilization of billions of shillings held by the Unclaimed Assets Authority. Additionally, a mandatory levy on employers who hire graduates, similar to the hotel and catering levy or the industrial training levy, has been proposed as a revenue stream.

The association’s chairman, Simon Gicharu, advocates for the establishment of a new funding entity—National Students Financial Aid Corporation—that would have the legal authority to source funding beyond government allocations.

He suggests that this corporation could impose levies on institutions and individuals benefiting from specialized training, establish an endowment fund, and invest for future sustainability. Efficient loan recovery mechanisms would also be prioritized.

Gicharu, who is also the founder of Mt Kenya University, highlights that this proposal aligns with recommendations from the Presidential Working Party on Education Reforms (PWPER) and the recent Cabinet decision to merge the Higher Education Loans Board (Helb) and the Universities Fund (UF).

Challenges with the Current Funding Model

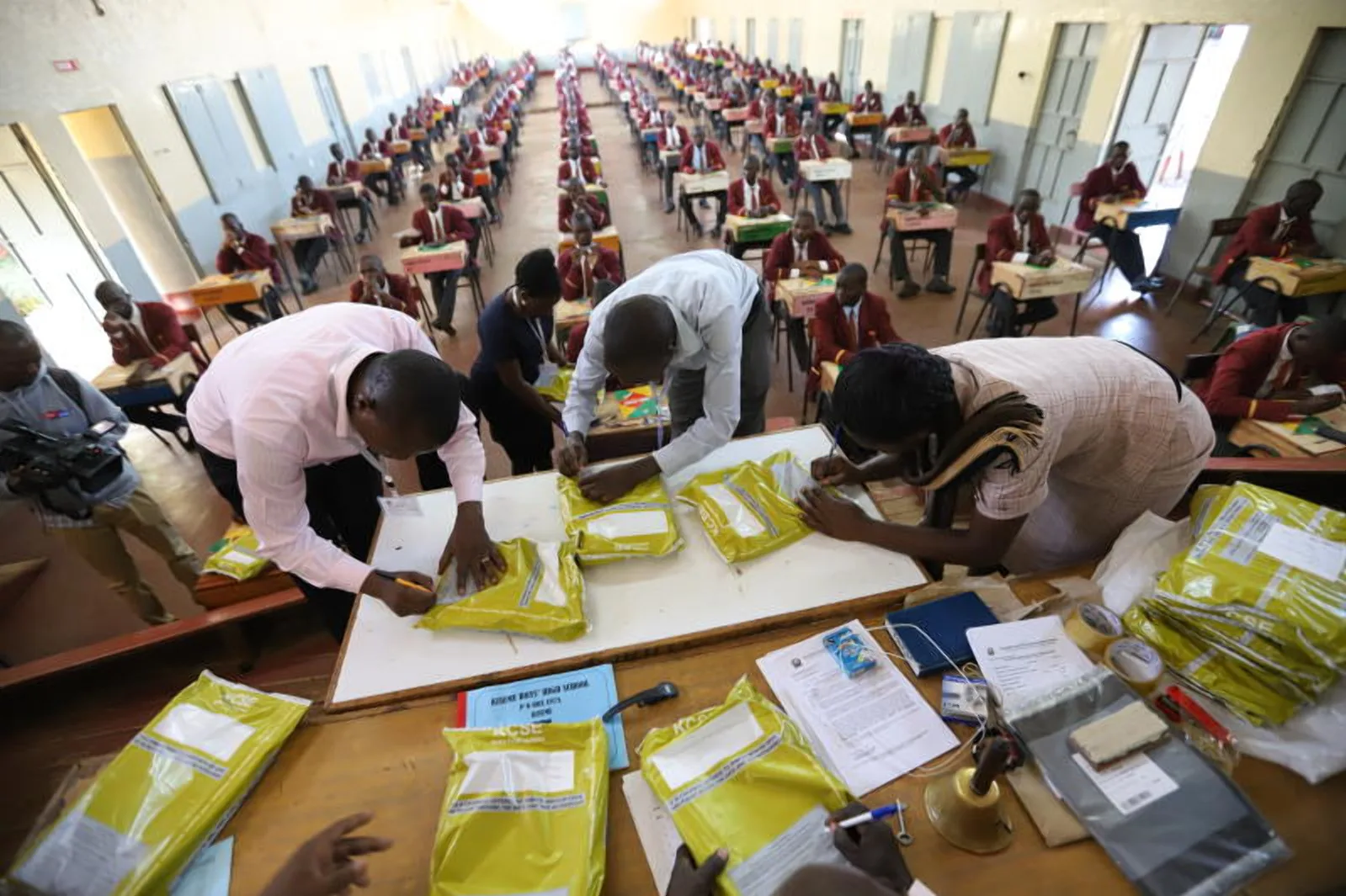

The government introduced a new university funding model in 2023 to address the Sh80 billion debt crisis plaguing public universities. This model was designed to finance students through a combination of scholarships and study loans, allocated based on financial need assessed through a Means Testing Instrument.

However, the model has faced challenges and was halted by the High Court in December, leading to a new crisis as many students struggled to pay tuition fees. Private university students were also affected as they lost access to Helb loans that had been granted under the nullified system.

Napuk proposes a revised model that assesses students’ economic backgrounds from secondary school rather than upon university admission.

Napuk acknowledges the strain caused by the rapid expansion of the higher education sector. University enrolment increased from 361,379 students in 2013 to 246,391 in 2024, necessitating a review of funding mechanisms.

The association emphasizes that such growth directly impacts financial requirements for university operations, tuition, and student upkeep.

Historically, the government has struggled to meet funding obligations. Under the Differentiated Unit Cost (DUC) model, which preceded the current structure, public universities received a maximum of 66% of required funding in the 2018/2019 financial year, while private universities received only 18%.

Read Also: Retiree Pension Delays Under Scrutiny as CAJ Orders Swift Payment

This shortfall led to unpaid tuition fees, salary arrears, and unremitted statutory deductions, accumulating to Sh80 billion in pending bills.

Bridging Programmes

Kapu acknowledged the government’s approval of bridging programmes for students who did not attain the minimum C+ requirement for university admission. These programmes offer an opportunity for students to advance their education and join tertiary institutions.

Rev Prof Ngari emphasized that private universities significantly contribute to Kenya’s economic growth by creating employment and providing skilled manpower. He highlighted that these institutions not only enhance education but also drive innovation and entrepreneurship.

Private universities play a key role in job creation across different sectors, thereby addressing youth unemployment, a major challenge in national development. Prof Ngari stressed that these institutions offer quality and affordable training, ensuring students complete their studies within the stipulated time.

Kapu Treasurer Prof Washington Okeyo reiterated that universities require substantial resources to fulfill their core mandates of teaching, research, and community engagement. He explained that maintaining infrastructure, utilities such as electricity and water, and hiring faculty and administrative staff require consistent funding.

Struggles with Fixed Costs and Borrowing

Prof Okeyo, who also serves as the Vice Chancellor of the Management University of Africa, pointed out that private institutions are struggling due to fixed operational costs. He stated that, regardless of whether classes are in session, these costs remain, making it difficult for universities to sustain their activities without government funding.

Due to financial constraints, private universities have resorted to borrowing from financial institutions to sustain operations. Despite the significant debt owed by the government, these institutions have continued educating students without sending them home.

Prof Okeyo highlighted that private universities have, in essence, been offering scholarships both directly and indirectly by accommodating students even without receiving the promised funds.

He further noted that some students who graduated two years ago were sponsored under the government programme, yet the institutions have not been compensated. He urged the State to fulfill its financial obligations so that universities can settle their loans and continue providing quality education without financial strain.

Private Universities Propose Radical Changes on Student Funding.

Follow Teachers Updates on Facebook, LinkedIn, X (Twitter), WhatsApp, Telegram, and Instagram. Get in touch with our editors at [email protected].

Discussion about this post